17 June 2020

About a month ago I talked about why I was buying SaaS and cloud stocks during the pandemic. One of the things I wanted to be able to analyze and monitor, was the overall technical action of the cluud and SaaS stock category, similar to how one might look at the SPY or QQQ ETFs, which track the S&P500 and Nasdaq-100 indexes respectively, to get a sense of the overall market.

At first I looked up cloud stock ETFs but it was difficult to sift through the sheer number of ETFs which all seemed to contain the stocks I was interested in, along with a whole bunch of stocks I wasn’t interested in.

I soon realized that instead of looking through individual ETFs and their holdings, I could do a reverse lookup using an ETF screener to find ETFs containing the stocks I was interested in. Several of the sites I found could only filter ETFs by a single stock at a time, which wouldn’t have been very practical given that I wanted to find an ETF containing several stocks. Eventually I stumbled upon https://www.etfchannel.com/finder/ which solved my problem perfectly, allowing me to screen ETFs by up to 40 stocks.

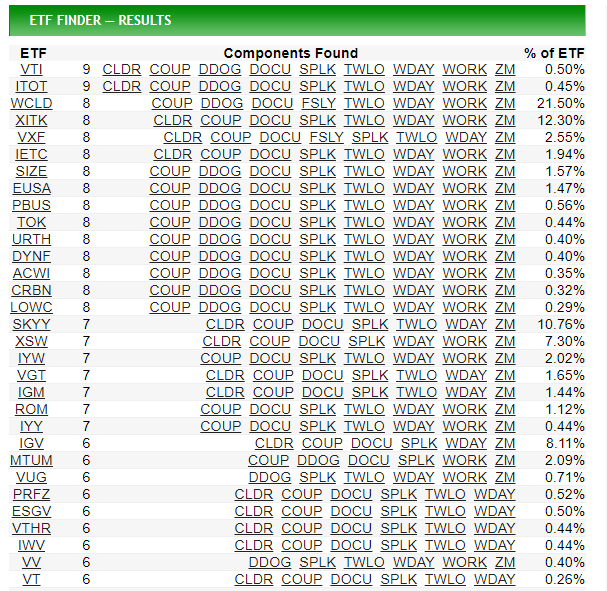

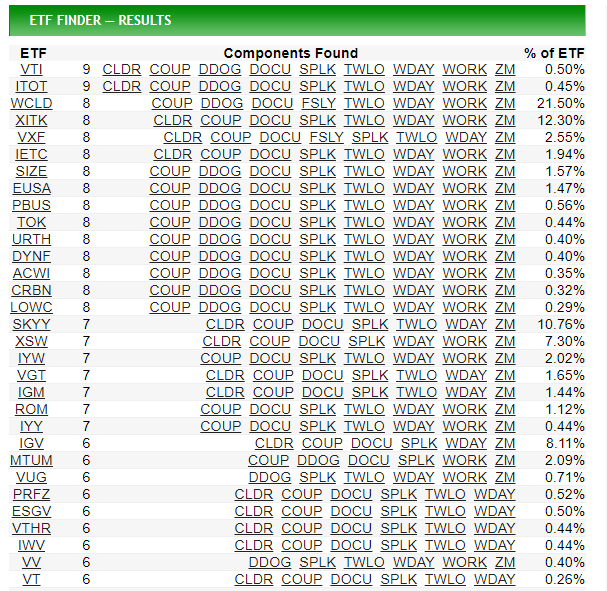

Here’s an example query which is pretty close to what I used last month: https://www.etfchannel.com/finder/?symbol=DOCU%2CWORK%2CZM%2CCOUP%2CDDOG%2CFSLY%2CTWLO%2CSPLK%2CWDAY%2CCLDR and the corresponding search results.

The search results are sorted by the number of stocks belonging to the ETF, and then what percentage of the ETF those holdings make up. The first two ETFs, VTI and ITOT actually contain 9 out of the 10 stocks in my search query, but those stocks only make up a small percentage of the ETF, 0.50% and 0.45% respectively. The third ETF, WCLD includes 8 out of the 10 stocks, but these results make up 21.50% of the ETF, heavily weighted toward the stocks in my search, which is exactly what I am looking for.

After discovering WCLD I have been monitoring the technicals to get a sense for market sentiment and demand for cloud and SaaS stocks which has worked out wonderfully for me. Although I don’t own WCLD yet, I like this idea of being able to use an ETF screener to target a niche category of stocks, and it’s something I’ll likely use again in the future.

Read more

01 June 2020

As a beginner in options trading, you’re likely to start out only buying calls and puts. Selling naked calls or puts is extremely risky and an easy way to blow up your account, while other basic strategies like the covered call and cash covered put require larger amounts of capital. Buying calls and puts is an easy way to get your feet wet with the options trading game, and requires a relatively small amount of capital compared to the potential gains.

Position sizing is also an important aspect of risk management in options trading. In other words, you should be comfortable losing some maximum dollar amount for a single options trade. Since options prices are proportional to their underlying stock prices, buying options for higher priced stocks can disproportionately expose the portfolio to increased risk toward these higher priced stocks.

To illustrate this point let’s look at an example. Slack (WORK) is currently trading around $35, and its at-the-money calls expiring next week are trading between $2 and $3, whereas Chipotle (CMG) is currently trading around $1050, and its at-the-money calls expiring next week are valued between $10 and $15. In this case, you would have to spend between $200 to $300 to buy the WORK call, but you would be looking at between $1000 to $1500 to buy the CMG call. The options prices would increase even more when you start looking at options with expiration dates further out.

So what’s the answer here? You can’t buy less than one options contract, or a fraction of a contract. You could stick to only buying options contracts that are within your budget. But there’s a better option here (no pun intended) and it is the vertical spread.

Read more

01 June 2020

Knowing trading lingo will not magically improve your investing game, but it will give you the tools to communicate and search for ideas that resonate with your short-term and long-term investing beliefs. Here are some of the basics you should know:

bull noun, bullish adjective

A bull is someone who believes a stock will go up in price. Bulls hold an optimistic view on a particular stock. You have a bullish view on a stock if you believe the price will go up. Bullish trading strategies assume the stock price will rise.

Example: I’m feeling bullish on TSLA.

bear noun, bearish adjective

A bear is someone who believes a stock will go down in price. Bears hold a pessimistic view on a particular stock. You have a bearish view on a stock if you believe the price will go down. Bearish trading strategies assume the stock price will drop.

Example: The bears have taken over recently.

long adjective

Being long a security essentially means buying and owning the security. If you buy shares of APPL, you are long apple. If you buy a call option, you own a long call.

Example: Buy the long call.

short noun, adjective, verb

Being short a security typically means you borrowed a security from your broker and now have an obligation to return it. If you sell short 100 shares of APPL stock, you borrow the 100 shares from your broker, sell the shares, and now owe the broker 100 shares of APPL stock. This could also refer to a person who shorts a stock.

Example: I’m short AAPL. I sold short 100 shares of AAPL. The AAPL shorts are out in full force.

open (a position) verb

Opening a position refers to establishing a new trade by buying a security, or selling short a security.

Example: Buy to open one call, or sell to open one call.

close (a position) verb

Closing a position refers to selling a security that was previously purchased, or buying back a security which was previously sold short. The act of closing a position effectively cancels out the open position.

Example: Sell to close one call, or buy to close one call.

debit noun

A debit is a price paid for opening a position, most commonly the price you pay for buying a security.

Example: Purchase one debit spread.

credit noun

A credit is money received at the outset for opening a position. Money would be paid back when the position is closed, resulting in a net profit if the amount paid back was less than the credit received, or a net loss if the amount paid back was more than the credit received.

Example: You receive a credit when you short stock.

Read more

22 May 2020

During the Covid-19 pandemic, certain industries have been hit harder than others. Many companies in the retail, airline, oil and banking industries are all down more than 50% from their 2020 highs in February. But while the Covid-19 virus has wreaked havoc on some industries, others such as cloud software and biopharma are thriving more than ever.

As a software developer, I am seeing first-hand how my company has not only been insulated from the economic damage of the pandemic, but is actually thriving during this tumultuous time. Many of the SaaS (Software-as-a-service) platforms that our company uses are more popular than ever. Businesses have been forced to undergo rapid digital transformation in order to adapt to the current state of the world. and because of that there is huge potential for growth in many of these cloud software companies.

Read more

02 October 2018

Over the last few years, I’ve expanded my investment strategy to include dividend growth investing in addition to index fund investing. Here are several websites that I use for finding and selecting dividend growth stocks. Many of these sites are not limited to only dividend growth stocks, but are great for general security analysis as well.

Read more